Introduction

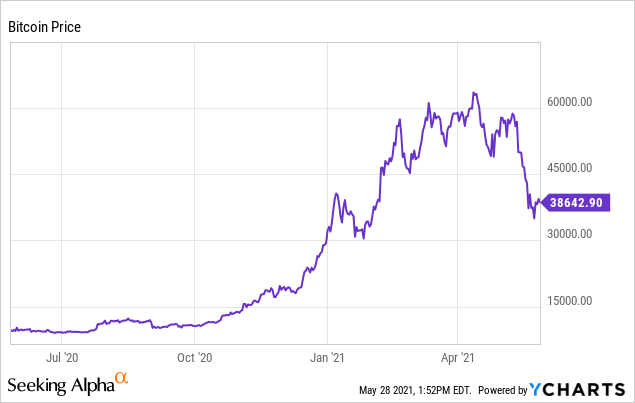

I wrote an article three weeks ago explaining why I was shorting the Bitcoin (BTC-USD) bubble. Many investors who followed my trade have made a nice profit during the last three weeks. Three days ago, I wrote another article to explain the fundamental causes of the recent 50% collapse in Bitcoin price and what could happen next. Many readers asked about my view on Bitcoin’s technicals. As such, in this article, I will focus on the technical analysis and share what I am planning to do.

What happened to Bitcoin in May?

As I explained during my previous article, Bitcoin’s price movement is following the textbook market psychology chart.

Source: Tradingview

At the moment, Bitcoin’s macro trend clearly indicates it is in a bear market, and Bitcoin is in the “denial phase” of the market psychology. Many Bitcoin influencers in Youtube and Seeking Alpha are completely ignoring the extremely bearish technicals and claiming this is somehow a normal level of correction, and Bitcoin will start roaring back to an all-time-high in few weeks. Even though that is possible, based on the extremely negative fundamentals (government regulation, ESG concerns, alt-coin dilution, Musk U-turn) and terrible chart pattern, I think it is more likely for Bitcoin to collapse back to the $15K range. In fact, Bitcoin is now significantly closer to $0 than to $100K.

In this article, I will explain what I think is the key resistance level that both Bitcoin bulls and bears should focus on before making any decisions.

$40K thin resistance: Just a dead-cat bounce?

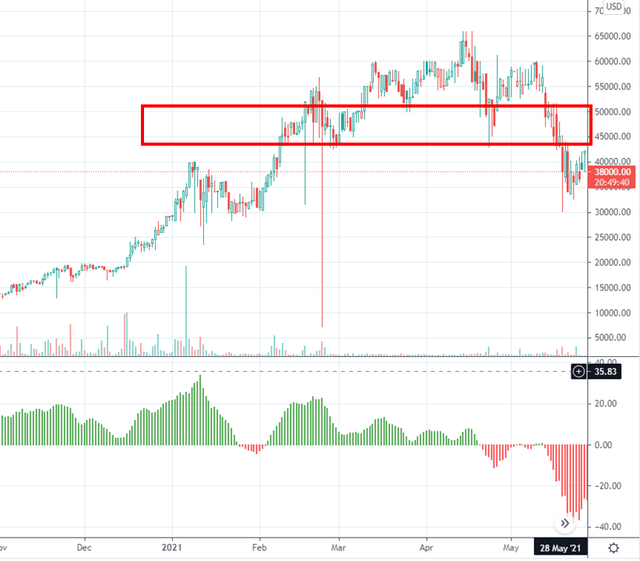

Source: Bitcoin/USD Trading View

During the last 2 weeks, after the massive $40K to $30K collapse, Bitcoin was able to rally and recover its losses and move back to the $40K mark. However, when Bitcoin reached $40K with an extremely strong bullish momentum, it has lost its momentum and has been hovering around the $40K resistance during the last few days. It seems like bulls really want to break the $40K mark, but there are lots of selling pressure that is constantly hammering down the bullish momentum.

If the $40K resistance breaks down, I think Bitcoin can easily collapse back to the $20-30k range in a heartbeat. I think this $40K mark is an important short-term resistance that Bitcoin bulls need to hold during the next few weeks. This is because, during the February bull market, $40K has been a key technical point where bulls needed several attempts to break above. In my opinion, the bulls were able to break that resistance because of Elon Musk and Tesla catalyst, Tesla buying 1.5Bn worth of Bitcoin.

If Bitcoin could go above the $40K mark and hold, there is a probability that Bitcoin can rise back to the $45-50K region. I think the $45-50K region would be the most important key resistance that will determine Bitcoin’s faith.

Key resistance: 45-50K resistance, why it is important

Source: Bitcoin/USD Trading View

The $45-50k resistance is an important number to keep in mind for both bulls and bears because of two reasons:

- First, this range was the key resistance that Bitcoin bulls had to attempt multiple times to break this march.

- Secondly, during the 2018 Bitcoin cycle, Bitcoin collapsed down to the $13K mark and rebounded back to $18K, which represents around 50% dead-cat bounce. Moreover, altcoins rallied close to 70% after the massive collapse around this time. Using 2018 price movement as a guide, 50-70% bounce from the $28-30K, 2021 low would be $45-51K.

Source: Tradingview – 2018 Bitcoin bubble collapse

Can Bitcoin Bubble Continue?

If Bitcoin breaks through the $45-50K mark and continuously goes up to the $55-60K mark like what we have seen during the Bitcoin rally in Q1 2021, I think there is a probability that Bitcoin could continue its bull-run to $100K. Since Bitcoin does not have cash flow, dividends, yields, or use-case other than speculation, Bitcoin’s price absolutely depends on what someone else is willing to pay. This means the upside is unlimited, and any price above $0 is an overvaluation for Bitcoin.

My Plan

In order to profit from a bear market, I believe investors should short the rips and cover at the key resistance levels. As I explained, I wouldn’t be surprised to see Bitcoin going up to the $45K mark, considering the technical pattern. However, considering the bearish fundamentals and the weak momentum that I am repeatedly observing, I don’t think Bitcoin could defend the $45K resistance for a long time. I think it is more likely for bears to drive it back down under $30K. I think $45K would be the point where investors who want to bet on Bitcoin’s further decline could start shorting it. If Bitcoin collapses under $40K, I think the key downside resistance could be around $30K and $20K. I think $29-31K could be the point where TSLA purchased Bitcoin, depending on the time of the purchase. It is a probability that Elon Musk may write bullish tweets to defend TSLA’s cost base, or Tesla (TSLA) may liquidate its Bitcoin position when the Bitcoin price nears the cost base. Even if Elon Musk decides to defend Bitcoin through his Twitter account, I think Elon Musk’s Bitcoin pump is losing its efficacy. For example, Elon Musk’s recent positive tweet regarding Bitcoin miners only drove Bitcoin price by $1,000-1,500, and the rally died off very quickly. If Bitcoin bears realize that Elon Musk is no longer a threat, then they will short Bitcoin more aggressively, driving Bitcoin price to another heinous decline. After breaking the $30K resistance, I expect Bitcoin to fall to the $19-20K level, which is Bitcoin’s 2018 bubble peak. At this point, the risk of shorting outweighs the potential gain; therefore, I am planning on covering my shorts.

Risks

Bitcoin is a speculative bubble and driven by irrational market psychology. It is extremely important for investors to set a clear stop-loss and a target price before shorting the bubble, as unexpected swings in Bitcoin prices could cause a forced liquidation. My main concern is some type of unexpected catalyst taking place out of nowhere that causes a 20-30% jump in Bitcoin prices. I think investors with a very high-risk tolerance should short Bitcoin. My advice for other investors who are not willing to take this level of risk is to stay on the sidelines and sell their Bitcoin position as I expect Bitcoin price to go much lower from here.

Conclusion

As I predicted in my previous article on May 5th, Bitcoin has collapsed more than 50% in less than 3 weeks. Bitcoin continuously failed to defend the $40K resistance after it bounced back to the $35-40K region after it went below $30K. It is highly probable that the Bitcoin Bear market is not over and it could fall considerably more from this level. I think Bitcoin is mostly driven by retail momentum and exotic catalysts. As such, in order to profit from trading Bitcoin, being a nimble technician who can read key technical trends and market psychology is extremely important. Both Bitcoin’s chart pattern and catalysts during May were extremely bearish. The macro chart pattern clearly indicates that the Bitcoin bull market is over. During the bull market, investors should buy the dips and seek to climb the mountain higher, but during the bearish downward, investors should think about shorting the bubble and glide down the mountain rather than trying to climb up. The key resistance to me is $45-51K based on the previous dead-cat bounce of Bitcoin and other altcoins in 2018. I think $45-51K would be a pivotal entry point for Bitcoin shorts. If this pivotal resistance breaks down and Bitcoin collapses down further, the target price for my short position would be $30K and $20K.

——————————————————

Originally Published On: Seeking Alpha

Photo courtesy of: Seeking Alpha

Follow Crypto News Now on Twitter: www.Twitter.com/CryptoNewsNow

Like Us On Facebook: www.Facebook.com/CryptoNewsNow